Credit Cards in Nepal, it’s History and Benefits | How to get one in Nepal

Credit cards in Nepal are cards that allows you to buy products and services on credit from places which accepts credit card . The payment for your goods and services is done by bank . But , you need to make payment to bank after a certain time . It benefits you by allowing you to buy products at current time even when you have no amount in bank currently . History of credit card in Nepal dates back to 1990s but it has become trend only in recent years . Benefits from a credit cards are enormous so applying for it in your local bank will be a smart decision .

What are Credit limits ?

Credit limits are maximum amount that you can spend using your credit cards . Banks set credit limits on basis of your income . It is maximum amount you can spend using credit cards . You cannot spend more amount than your credit limit from Credit Cards .

How can you increase your credit Limits ?

You can easily increase your credit limits by following these tips :

- Timely payment of your credit to the bank . It increases your credit worthiness .

- Use only 30 % from your credit payment .

- Submit a proof to your banks about the recent increment in your income .

- Simply applying for a new Credit card will also increase your credit limit .

To read in detail about these tips Read this awesome blog from ICIC Bank .

Credit Card vs Debit Card in Nepal

History Of Credit Cards

History of Credit Cards dates back to 1887 where ” credit card ” term was used in the novel named “Looking Backward ” from Edward Bellamy . Then in late 1800s traders regularly gave credits to their most loyal customers . After a while in late 1900s oil companies started using first store credit cards . In 1958 American Express launches it’s first launch cards . And in 1966 Bank Americard launches it’s first general purpose credit card . Thus , the technology of Credit Card has been developing from then till now .

History of Credit Card in Nepal

The usage of Credit card has increased significantly over the past decades. In the context of Nepal the first bank to ever introduce the Credit card was Nabil Bank ltd in early 1990’s and the first ATM machines were introduce by Himalayan Bank ltd in 1995 A.D. Though Nabil bank introduced the Credit card system, the transaction were only possible for the International transaction. As a result it was not available for domestic transaction.

Himalayan bank the for the first time offered the credit card services in Nepal. Making the cards available for the people of Nepal for the domestic transaction. Though the system of credit card came, it was not popular back in the days. But in the later year, the trend of Credit card boosted the banking sectors which became possible with the advancement of IT. With the help of E-banking and Mobile banking, now people can easily utilize and make transaction online through their Mobiles.

Benefits of Having a Credit Card in Nepal :

In this modern age having a credit card has become a necessity . You can get various rewards from different merchants just by paying from you credit card . Even in Nepal you can get discounts from different shops and restaurants just by paying from Credit Cards . There are few benefits of using Credit card listed down below :

- Rewards and Offers

- Option of Paying later

- Availability of EMI/Installments

- Easy to make payment in other Countries .

- Easy to keep track of your expenses .

1.Rewards and Offers

Different e-commerce sites like Daraz offers discounts and rewards time to time for making the payment through Credit Cards in Nepal . We can also get exclusive offers on different restaurants , jewellary shops in Credit Cards . For example if you have a credit card of sunrise bank then you can get 20% discount on gold making charges from Dokanya Jewellers . Some exclusive offers that you can get from few banks are given below :

| Banks | Rewards |

| Sunrise Bank Ltd | Sunrise Bank Ltd Credit Card Offers |

| Mega Bank Ltd | Mega Bank Ltd Credit Card Offers |

| Machhapuchchhre Bank Ltd | Machhapuchchhre Bank Ltd Credit Card Offers |

| Nepal Investment Bank Ltd | Nepal Investment Bank Ltd Credit Card Offers |

You can simply click in the links to check the offers and discounts in Different Credit Cards in Nepal .

2. Option of paying later

When you have Credit Card in Nepal . You always have an option of paying later for the products you buy. Your bank makes the payment for your products on your behalf . And after a certain time you can pay your bank back . For example let’s say you want latest Samsung Galaxy S22 but currently you cannot buy the product due to less balance . In that case you can buy yourself the latest Samsung mobile and pay from your Credit Cards easily and pay the price of it to your bank later .

3. Availability of EMI/Installments

EMI in a simple way can be defined as buying a product today and paying for it in installments in monthly basis . In Nepal as well EMI service is available . More on EMI Service can be found on Fatafat Sewa .

Lets see an example on how you can buy product on EMI on Fatafat Sewa . Let’s say you need to buy iPhone 13 pro on EMI , so here is what you need to do :

- First go to Fatafat Sewa there you can find apply for EMI just beside your add to cart

- Then login with your info

- After that Fatafat Sewa themselves will send the quotation to the bank that you have credit card of .

- In next two days bank will accept your quotation then you need to go to bank and sign the quotation .

- Then with that quotation signed you have now brought new iPhone 11 pro from Fatafat Sewa .

Best thing about Fatafat Sewa is , we have made the complex EMI process really easy for you . And in a really quick time we fulfill all your requirements . We Fatafat Sewa team try our best to make the processing of EMI easy .

4. Easy to make payment in Other countries

Credit Cards of Nepal is widely accepted in India and Bhutan . You can travel all around India and Bhutan , and use your Credit Card as payment method . So , next time when you travel around India just carry your Nepali Credit Card and make the payment .

5. Easy to keep track of your expenses

While using a Credit Cards you get a alert message from the banks which makes it easier for you to track your expenses at the end of a month . It also helps you in planning the resources and expenses that you currently might not realize .

How to apply for Credit Card in Nepal ?

Now we know the benefits of Credit Card in Nepal . Let’s talk about how can you apply for Credit Card in Nepal .

- Choose a bank that you want Credit Card .

- After that either visit their nearest branch or apply online for a form of Credit Card .

- Submit your documents if you choose to visit the nearest branch .

- Then after some time you will get your Credit Card .

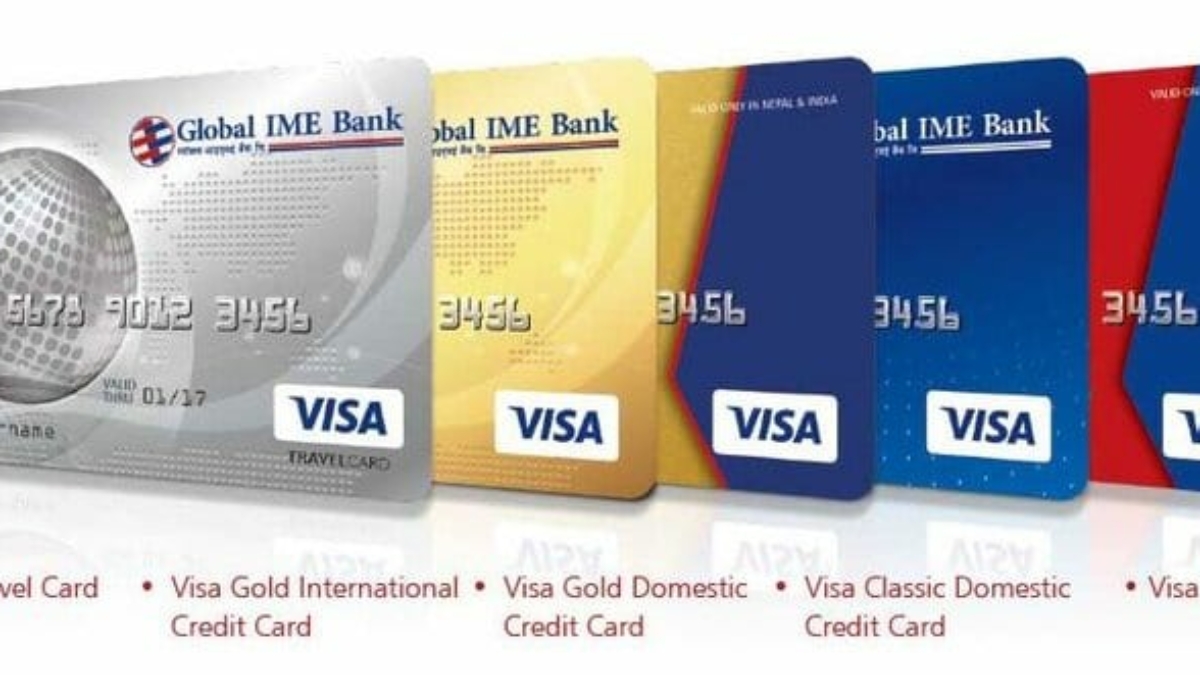

Few banks in Nepal from where you can apply credit card online :

| Banks | Links to apply online |

| Global IME Bank Ltd | Click here to apply Credit Card Online |

| Sunrise Bank Ltd | Click here to apply Credit Card Online |

| Citizens Bank Ltd | Click here to apply Credit Card Online |

| NABIL Bank Ltd | Click here to apply Credit Card Online |

| Siddartha Bank Ltd | Click here to apply Credit Card Online |

| Century Bank Ltd | Click here to apply Credit Card Online |

| NIC ASIA Bank Ltd | Click here to apply Credit Card Online |

| Mega Bank Ltd | Click here to apply Credit Card Online |

| Sanima Bank Ltd | Click here to apply Credit Card Online |

| Machhapuchchhre Bank Ltd | Click here to apply Credit Card Online |

Documents Needed For Applying Credit Cards in Nepal

Any people age of 18 or above can apply for the credit card. The applicant can apply the credit card by providing the following documents to the bank.

- Customer having Saving/current account in their respective banks.

- Applicant should have Monthly Salary fifteen thousand or above.

- Copy of Citizenship certificate.

- Recent passport sizes photo of card applicant.

- Latest annual salary certificate.

- Company registration certificate, PAN, latest tax clearance and audit of the company.

- Foreign nationals should provide their certificate of registration issued by the embassy.

Fees in Credit Card in Nepal

Credit card processing fee ranges from about 1.3% to 3.5%, plus the payment processor’s cut which varies depending on the card processor and the plan you choose. To accept credit card payment, merchants must pay interchanges fee, assessments and processing fees.

Some of the fee structure of credit card by banks are listed below.

| Fee Structure | Nepal Bank | Everest Bank | Laxmi Bank | Kumari Bank | Prime Bank |

| Joining Issuance Fee | 750 | 300 | 500 | 500 | 700 |

| Replacement Fee | 750 | 500 | 1000 | 300 | 700 |

| Pin Re-Issue | 50 | 100 | 150 | 100 | 150 |

| Late Payment Fee | 300 | 250 | 300 | n/a | 300 |

| Over Limit Fee | 500 | 500 | 500 | n/a | 500 |

| Limit Enhance Fee | 500 | 200 | 500 | n/a | 500 |

| Annual Fee | 750 | 500 | 1000 | 300 | 700 |

Best Banks To apply Credit Card in Nepal

Presently most of the banks in Nepal provides Credit cards for its customers. These are some of the best banks with its interest rates and to apply for the card click on the bank link in the bank name :

| Banks | Interest Rates | Validity date |

| Citizens Bank | Visa Credit Card : 2% per month | 3 years |

| Kumari Bank Limited | Credit Card : 2% per month | 5 years |

| Nabil Bank | MasterCard : 2.25% per month Visa Card : 2.25% per month Credit Card : 2% per month | 4 years 4 years 3 years |

| Global IME Bank | Visa Classic Card : 2% per month | 5 years |

| Mega Bank | Visa Credit Card : 2% per month | 3 years |

| NIC Asia | Visa Card : 2% per month | 5 years |

| Century Bank | CCBL Credit Card : 2% per month | 3 years |

| Siddhartha Bank | (UNO) Credit Card : 2% per month Credit Card : 2% per month | 3 years 5 years |

| Sunrise Bank | Credit Card : 2% per month | 5 years |

Conclusion

Credit Cards in Nepal is highly beneficial . You can get various rewards and discounts just by having a credit cards . You can shop easily on sites like Fatafat Sewa . Credit Cards offers you the best interest in Nepal . With Credit period of around 45 days you can always easily be benefited with the credit cards .

So , HOW MANY OF YOU GUYS HAVE CREDITS CARDS ?? Feel free to Comment down below .